Future Bookings Report

a look at the next quarter in the vacation rental market

presented by

Summary

The short-term rental industry rebounds by catering to domestic travelers, staycationers and remote workers

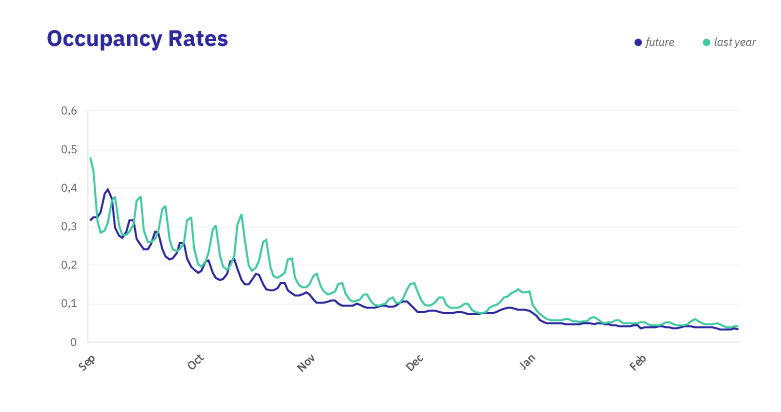

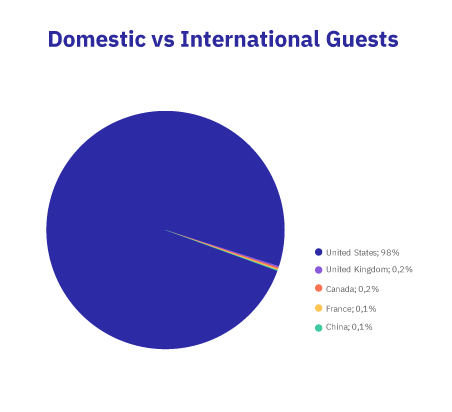

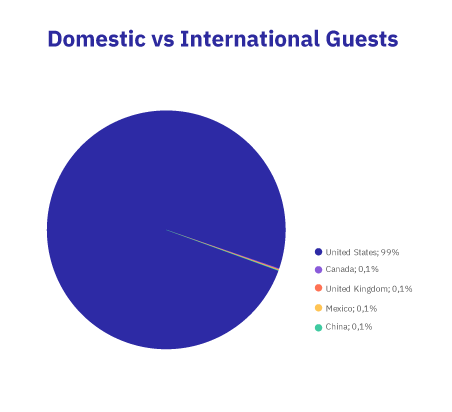

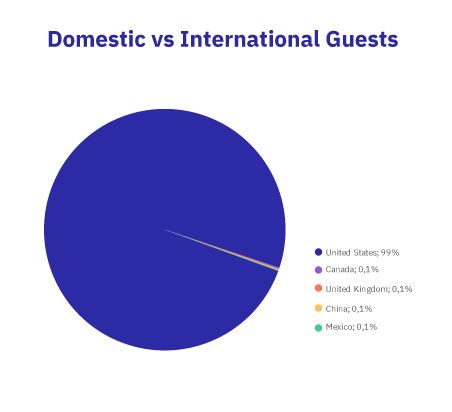

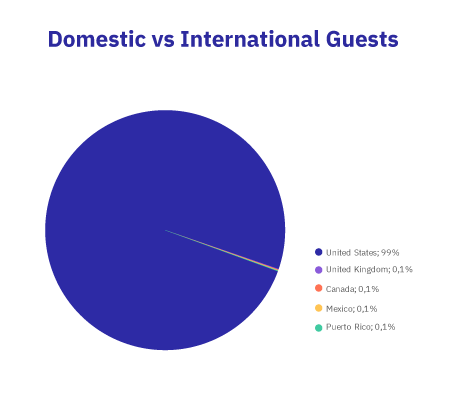

In our previous future bookings report, we saw encouraging signs that a recovery in the short-term rental industry was brewing. Although occupancy rates were still below 2019 levels, the signals couldn't be ignored. Like many had predicted, travel bans, border closures and general guest unease with air travel were three factors likely to trigger a surge in domestic travel. Fast-forward to September 2020 and it's safe to say that domestic travel is in.

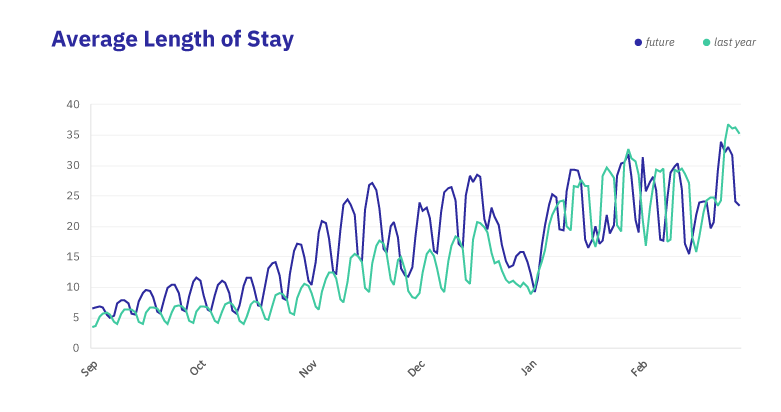

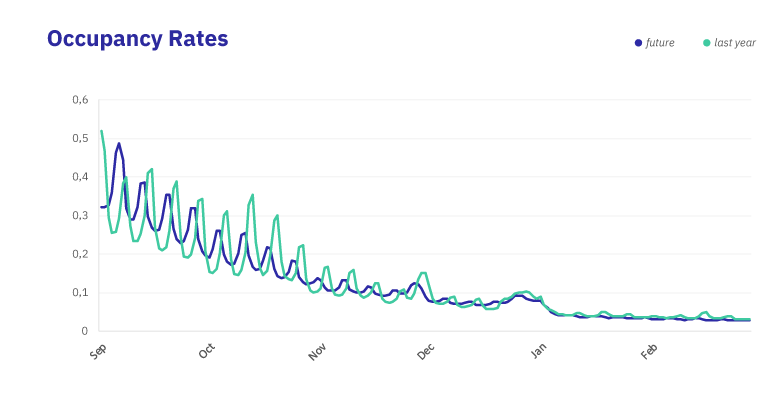

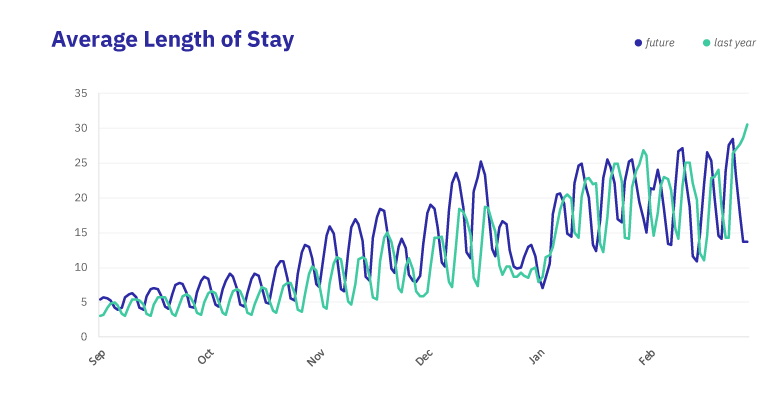

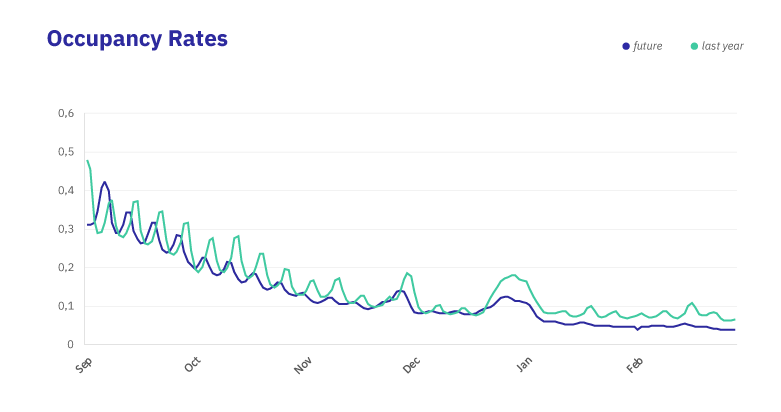

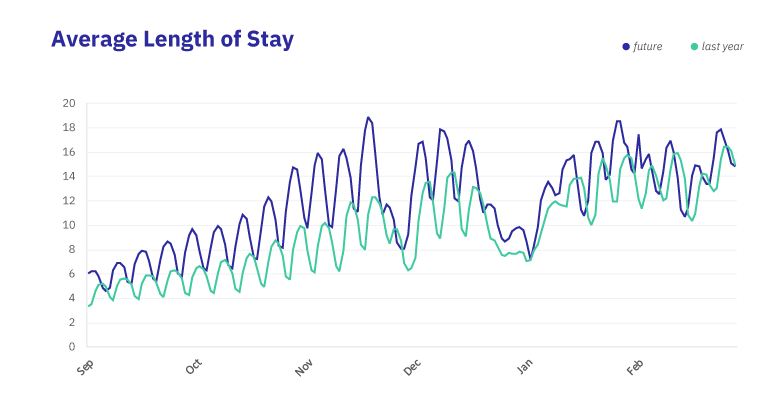

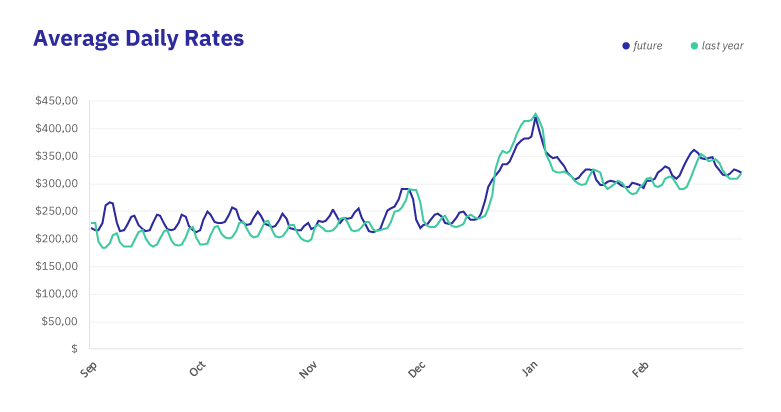

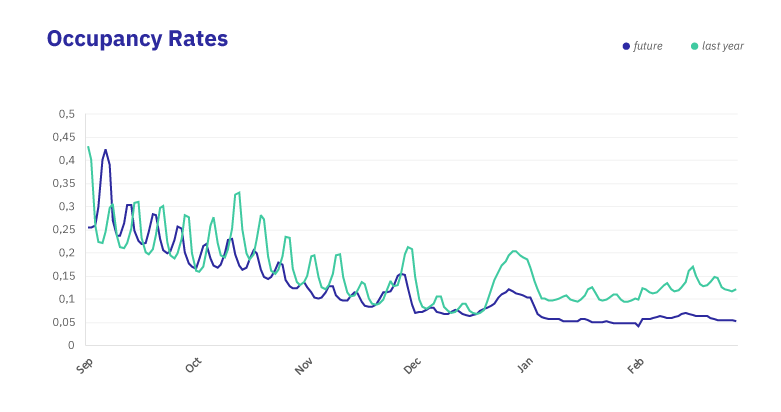

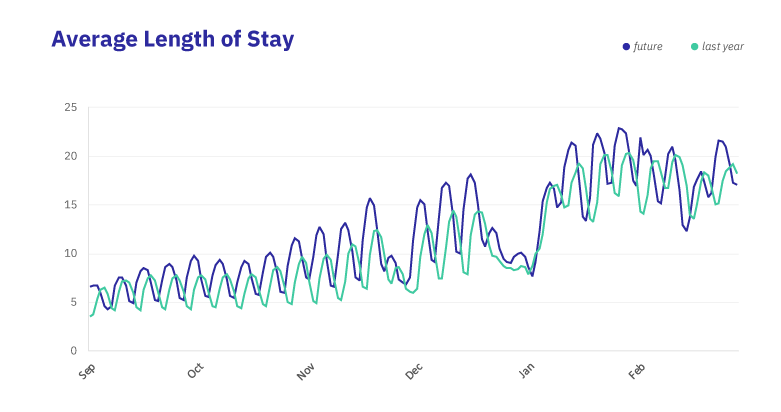

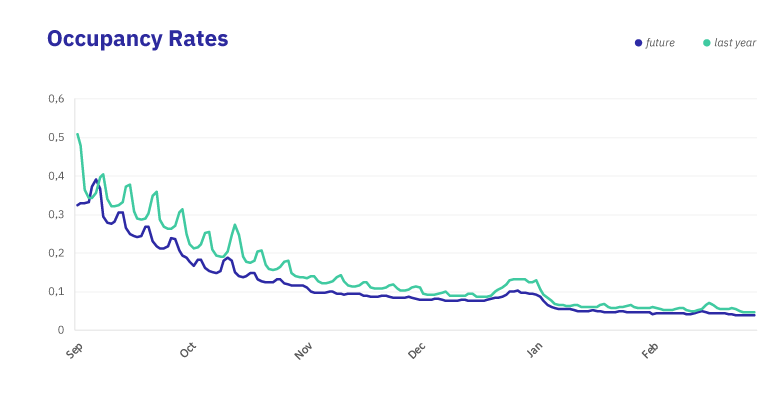

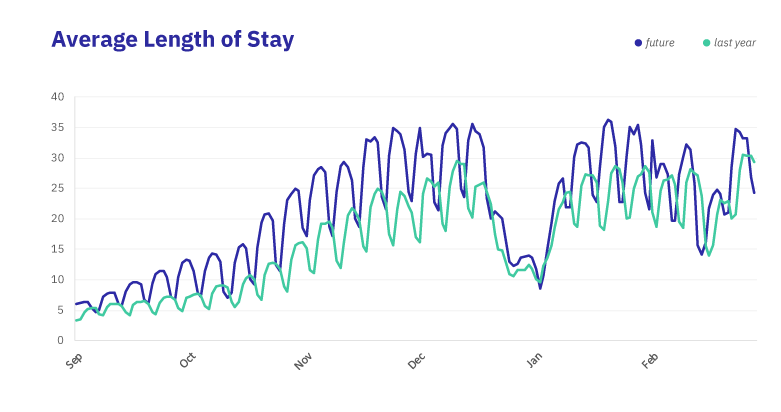

So what does the next quarter look like? For one thing, in almost every market we're still seeing lower occupancy rates. However, Average Lengths of Stays are much higher than for the same periods in 2019. This trend is unsurprising given the transition from office to remote work. Workers who are spending entire days and nights in the same spaces are seeking a change of scenery. By being able to work remotely, guests can extend their stays by an extra day or two. A parallel trend that may explain the shift in longer stays are workers temporarily leaving urban centres to work remotely in rural settings or cottages. These reservations typically range from 7 to 31 days at time, which would also drive up the Average Lengths of Stays.

For vacation and short-term rental owners and managers, this is an important shift that can be capitalized on to attract week and month-long reservations. To attract remote workers, it will be important to upgrade internet and wifi speeds in the properties (and include that in your listing). And since many remote workers are millennials - a generation with higher percentages of pet ownership - changing the listing to pet-friendly will be key to improving searchability on OTAs and listing sites.

As we enter into the fall and winter holiday season, we expect to see relatively strong performances in the industry as guests continue to shy away from traditional hotels in favor of vacation or short-term rentals.

In this report

Important industry news

and trends

Vacation rental booking

data by region

Top and trending North American markets

Useful links to interpret

and action the data

Vacation rental industry trends and news

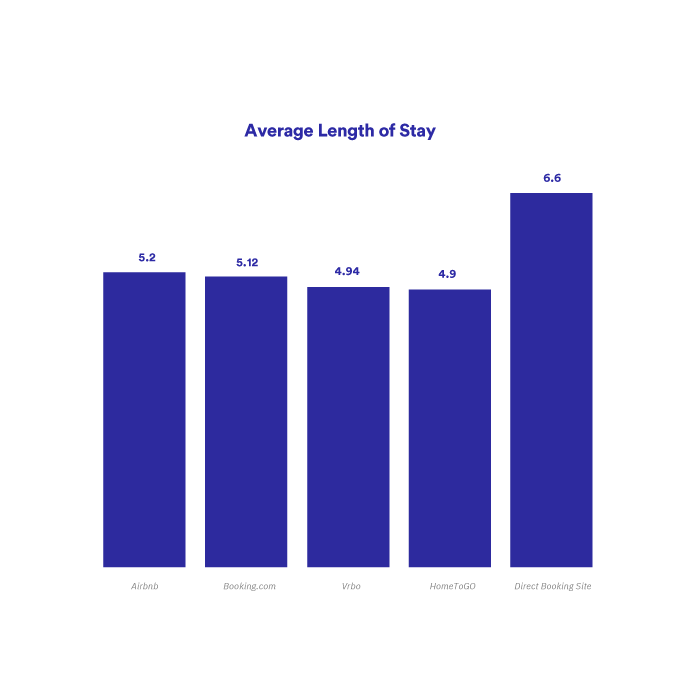

Hosts and managers with direct booking sites convert leads into longer reservations

A look at the Average Lengh of Stay of all reservations booked through properties managed by Hostfully clients during the Summer of 2020 shows that direct booking sites tend to acquire longer stays than traditional OTAs and listing sites. Possible reasons for this trend are multiple:

- Direct booking sites can push powerful branding onto visitors, which translates to better consumer confidence

- Hosts and managers can offer incentives like a free night's stay to increase the odds of converting a lead into a reservation

- Repeat guests who are already aware of the upcoming quality experience of their stay may be more inclined to booking longer reservations

VRBO takes a stance on 'lockdown parties'

Since the start of the pandemic, the new troubling trend of lockdown parties has affected vacation and short-term rental hosts with properties capable of accommodating large groups. In response to public and lawmaker demand, Vrbo recently announced that it would ban all one-night rentals for Arizona properties listed on its site. Over the next quarter, we'll be paying attention to this trend. Will other states ask OTAs and listing sites to do the same? And if this spreads across platforms and various states, how will this affect owners and manages who cater to business travelers that may only need a rental for one night?

Google enters the vacation rental listing world, Booking.com jumps onboard

Google's new standalone vacation rental portal will be an online travel agency that will show potential guests rates, reviews and other content for each listing. OTAs like Booking.com have opted to participate and will make properties available on Google. In a strategic play, Airbnb has recently opted out of the platform. Given Google's share of internet search traffic, hosts and managers should consider listing their properties on platforms and OTAs likely to take advantage of Google's new vacation rental feature. Full story on Skift.

Booking.com to close offices and lay off staff

On a live call with more than 800 employees on September 10th, Booking.com announced cutbacks and the closure of at least five offices around the world as a result of the economic downturn caused by the pandemic. The immediate impact on owners and managers remains unclear, however, news that Booking.com customer service specialists have been laid off could lead to longer wait times to resolve listing, reservation or payment issues for hosts and managers.

Talks of an Accor & InterContinental Hotels Group (IHG) merger

Two of the largest hospitality and hotel services providers have reported studying the possibility of a merger. As well-established industries face competition from disrupting technologies (the short-term rental industry), mergers aimed at taking advantage of economies of scale are likely to be more common. This is a major development for our industry and an encouraging sign for hosts and managers to keep pushing forward.

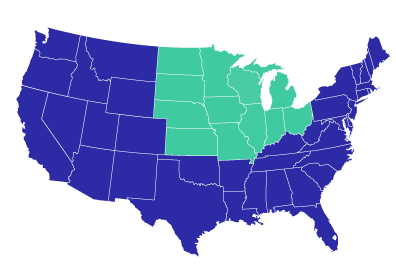

Vacation rental booking data by region

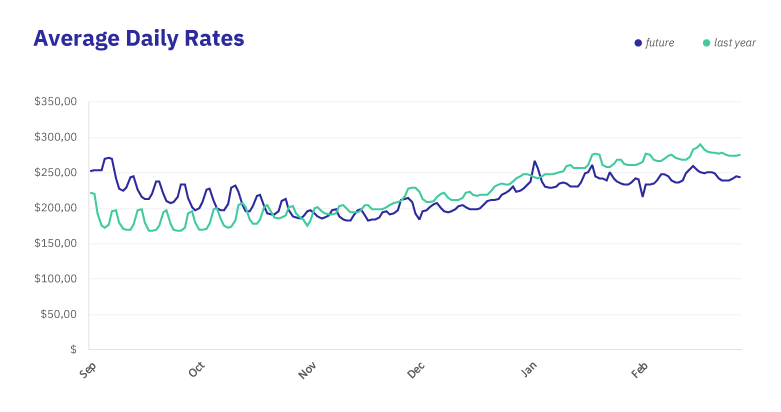

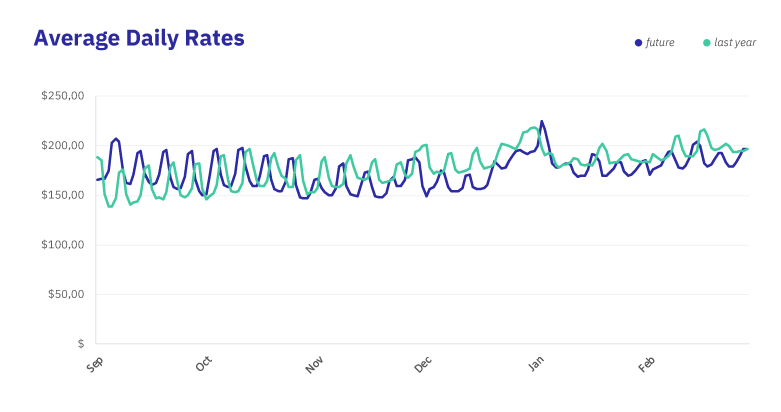

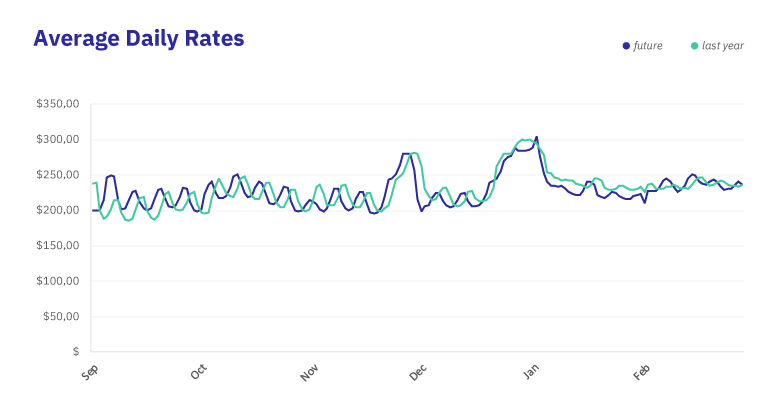

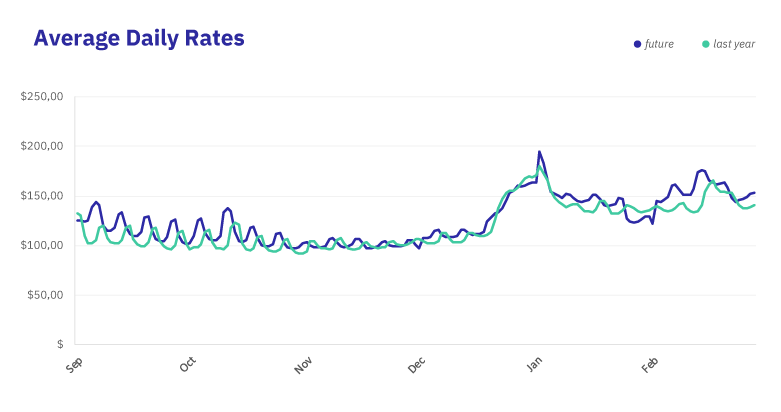

Successfully operating a vacation rental business involves a lot of moving parts and processes. One of those is adjusting your nightly rates. Some vacation rental industry veterans will argue it's part science, part art. The old way to do that involved increasing your nightly rates slowly until you noticed a drop in occupancy rates. While that may work for a gig economy host, there's a better way if you're a vacation rental business owner or manager.

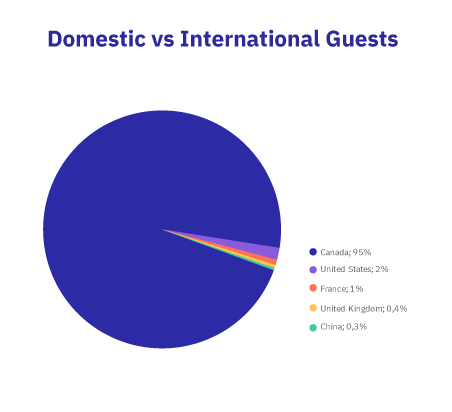

The solution is to look at market data and analyze it to find trends. By understanding how your market is transforming over time, you can adjust your nightly rate to match your competition and attract potential guests. Similarly, by looking at your market's occupancy rate compared to your average daily rate, you can determine if your marketing efforts are successful at converting potential guests. Finally, by looking at the ratio of domestic vs international travelers, you can fine-tune your marketing audience and potentially list on vacation rental listing sites other than Airbnb and Vrbo that are visited by your most frequent guests.

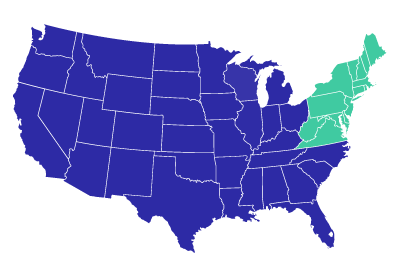

United States - Northeast

Data represented from the following regional sub-markets:

• Connecticut

• Maine

• Massachusetts

• New Hampshire

• New Jersey

• New York

• Pennsylvania

• Rhode Island

• Vermont

• District of Columbia

United States - Midwest

Data represented from the following regional sub-markets:

• Illinois

• Indiana

• Iowa

• Kansas

• Michigan

• Minnesota

• Missouri

• Nebraska

• North Dakota

• Ohio

• South Dakota

• Wisconsin

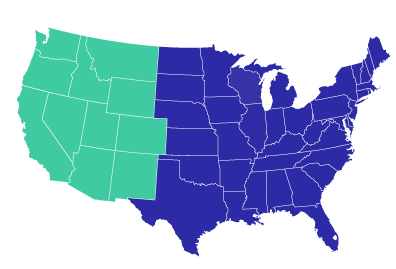

United States - West

Data represented from the following regional sub-markets:

• Alaska

• Arizona

• California

• Colorado

• Hawaii

• Idaho

• Montana

• Nevada

• New Mexico

• Oregon

• Utah

• Washington

• Wyoming

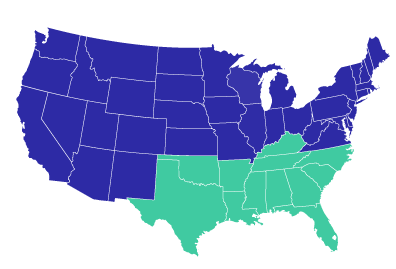

United States - South

Data represented from the following regional sub-markets:

• Alabama

• Arkansas

• Delaware

• Florida

• Georgia

• Kentucky

• Louisiana

• Maryland

• Mississippi

• North Carolina

• Oklahoma

• South Carolina

• Tennessee

• Texas

• Virginia

• West Virginia

Canada

Data represented from the following regional sub-markets:

• Toronto

• Montreal

• Vancouver

• Ottawa

• Calgary

• Winnipeg

• Halifax

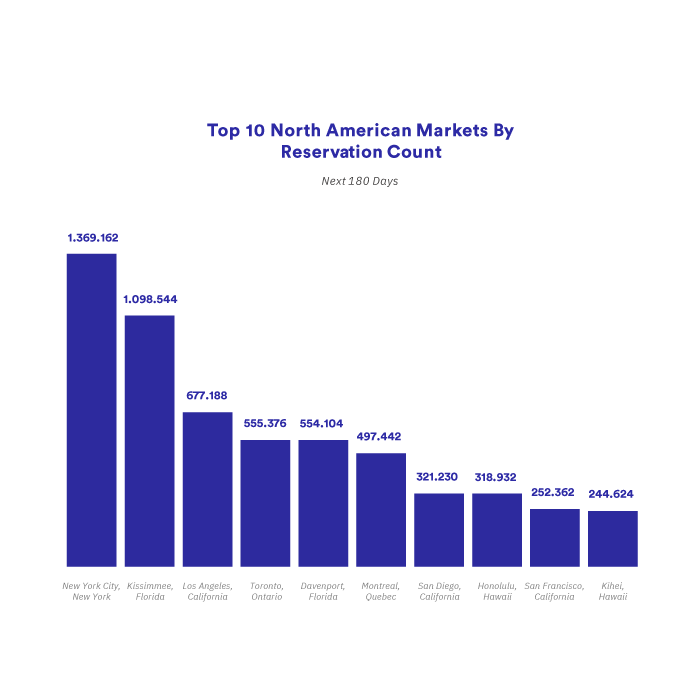

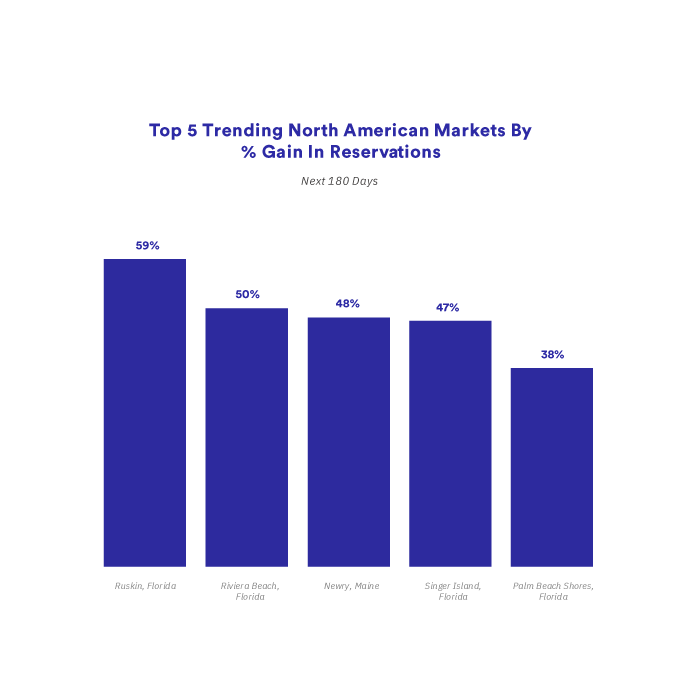

Trending vacation rental markets

Looking at trending vacation rental markets can yield important insights for owners and managers - even if they don't have properties in hot areas. A shift towards one type of niche market can be an early sign of a new travel trend. Or it can show a cyclical seasonal travel trend.

Useful links

Data is only useful if you take action on it. Here are a few articles with actionable tips and tricks to help you make the most of it:

- Market your properties to more potential guests with better distribution by Hostfully

- Boost bookings and outperform competitors with better branding by Hostfully

- Introduction to analytics for vacation rental managers by Hostfully

- What’s a good occupancy rate and how can you improve yours? by AllTheRooms

- How much should you charge for your vacation rental? by AllTheRooms

Get more city or county-specific vacation rental data

Boost your marketing, automate tasks, and increase efficiency

AllTheRooms Analytics is the leading provider of short-term rental analytics. They track over 12 million properties on Airbnb and Vrbo in more than 200,000 global markets. This data provides actionable insights to vacation rental hosts. See what powerful data-driven insights can do for your business.

Hostfully is an award-winning property management platform (PMP) and digital guidebook provider designed for vacation rental owners and managers. Features like a central calendar, multi-channel distribution, automated messaging, integrations and much more allow hosts and managers to operate their property portfolio at scale.